Beginners Guide on How Kovo Credit Builder Works

Jan 27 2026

If you are trying to build credit from scratch or want to repair a low score, chances are you’ve come across Kovo Credit Builder. It promises something that sounds almost too simple: build credit without borrowing money, without interest, and without a hard credit check.

So how does it actually work?

This beginner-friendly guide explains how Kovo Credit Builder works step by step, what gets reported to credit bureaus, how long it takes to see results, and whether it’s a good fit for your credit goals.

What Is Kovo Credit Builder?

Kovo is a credit-building platform, not a traditional loan or credit card. Instead of lending you money, Kovo helps you build a positive credit history by reporting on-time monthly payments to major credit bureaus.

You don’t receive a loan.

You don’t carry debt.

You don’t pay interest.

You simply make a small monthly payment, and Kovo reports it as a positive payment history.

Sign up at Kovo Credit Builder here.

Who Is Kovo Best For?

Kovo works best for people who:

Have no credit history

Have poor or fair credit

Want to avoid debt and interest

Were denied traditional credit cards

Want a low-risk way to build credit

It’s especially popular among beginners who want to start building credit safely.

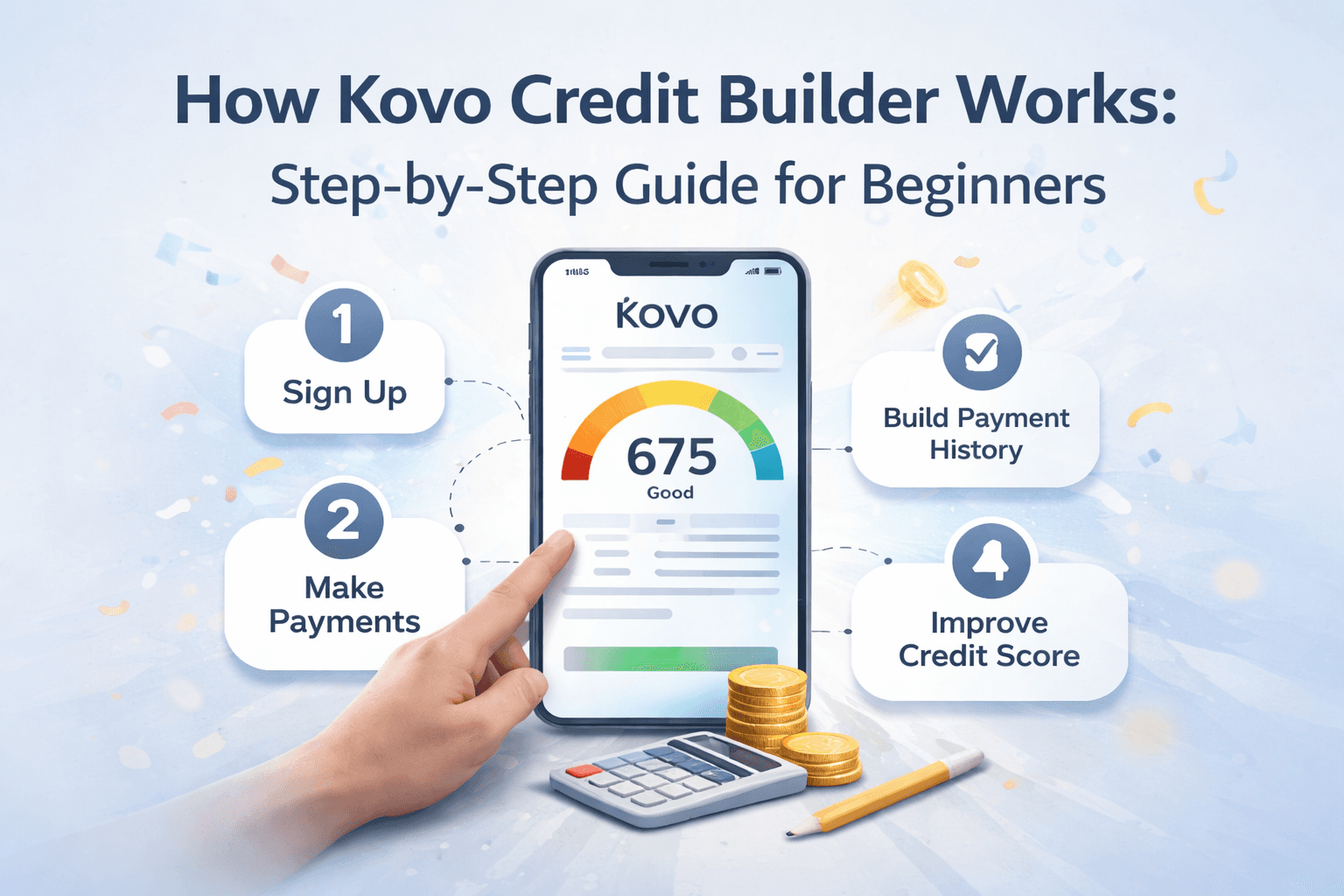

How Kovo Credit Builder Works (Step by Step)

Let’s break the entire process down clearly.

Step 1: Sign Up for a Kovo Membership

Getting started is simple.

You:

Create an account online

Choose a monthly membership plan

Link a payment method

There is no hard credit check during sign-up, which means your credit score is not affected just by joining.

Step 2: Make Your Monthly Membership Payment

Once enrolled, you pay a fixed monthly fee.

This payment is not interest.

It is not a loan repayment.

It is not money you borrowed.

Instead, it functions as a credit-building activity.

The key thing is consistency. Making on-time payments is what builds credit.

Step 3: Kovo Reports Payments to Credit Bureaus

This is where the credit-building happens.

Kovo reports your on-time payments to multiple credit bureaus, including:

TransUnion

Equifax

Experian

Innovis

These reports help establish or improve your payment history, which is one of the most important factors in your credit score.

Step 4: Your Credit Profile Starts Building

As your payments are reported:

Your credit file becomes active (if you had no score)

Your payment history improves

Your overall credit profile strengthens

For beginners, this can be the first step toward becoming credit-visible.

Step 5: Optional Credit Boost Features

Depending on your plan, Kovo may offer credit boost tools that help accelerate reporting or maximise impact.

These tools don’t involve borrowing more money. They focus on strengthening how your positive payment behaviour appears on your credit report

How Long Does It Take to See Results?

Credit building is not instant, but it is predictable.

Typical timelines:

30–60 days to see first reporting activity

2–3 months for early score movement

6+ months for stronger, more stable improvement

Results vary depending on your starting point, existing debts, and overall credit habits.

Why Kovo Works Without a Loan?

Most credit builders rely on credit-builder loans, where you borrow money and pay it back over time.

Kovo takes a different approach.

Instead of debt:

You pay a membership fee

The payment itself is reported

No borrowed money is involved

This removes the risk of:

Interest charges

Missed loan payments

Debt accumulation

For beginners, this is a safer entry point.

What Credit Factors Does Kovo Help With?

Kovo mainly helps with:

Payment History

The most important factor in your credit score. On-time payments improve this over time.

Credit File Activity

If you have no credit, reporting helps create activity so lenders can see you.

What Kovo does not directly impact:

Credit utilisation

Credit mix from loans or cards

That’s why Kovo works best as a foundation tool, not a complete credit solution on its own.

Does Kovo Affect Your Credit Score Negatively?

Used correctly, no.

As long as:

You make payments on time

You avoid missed or late payments

Kovo is designed to be low-risk. However, missing payments could negatively impact your score, just like with any reported account.

Kovo vs Traditional Credit Cards

Here’s a simple comparison.

Feature | Kovo | Credit Card |

Hard credit check | No | Usually yes |

Interest | No | Yes |

Debt risk | None | High if misused |

On-time payment reporting | Yes | Yes |

Beginner-friendly | Very | Not always |

Kovo is often easier for beginners to manage responsibly.

Common Beginner Mistakes to Avoid

To get the most out of Kovo, avoid these mistakes:

Missing payments

Cancelling too early

Expecting instant score jumps

Using Kovo as your only long-term credit tool

Consistency matters more than speed.

How to Maximise Results With Kovo

To build credit faster and smarter:

Pay on time every month

Keep your membership active for several months

Combine Kovo with responsible use of a secured card later

Monitor your credit reports regularly

Kovo works best when paired with good financial habits.

Is Kovo Worth It for Beginners?

For many beginners, yes.

Kovo is:

Easy to use

Low risk

Debt-free

Beginner-friendly

It’s not a magic fix, but it can be a strong first step if you’re starting from zero or rebuilding after mistakes.

Who Should Not Use Kovo?

Kovo may not be ideal if you:

Already have excellent credit

Want access to spending power

Prefer traditional credit cards

Are unwilling to commit to monthly payments

It’s a tool, not a one-size-fits-all solution.

Final Thoughts: Is Kovo a Good Way to Start Building Credit?

Kovo Credit Builder offers a simple, low-stress way to start building credit, especially for beginners who want to avoid debt and interest.

If you stay consistent, make on-time payments, and use it as part of a broader credit strategy, Kovo can help you lay a solid foundation for your financial future.

Credit building is a marathon, not a sprint. Kovo helps you take the first few steps safely.